(JJ: “I resemble that remark…”) 🫙💅

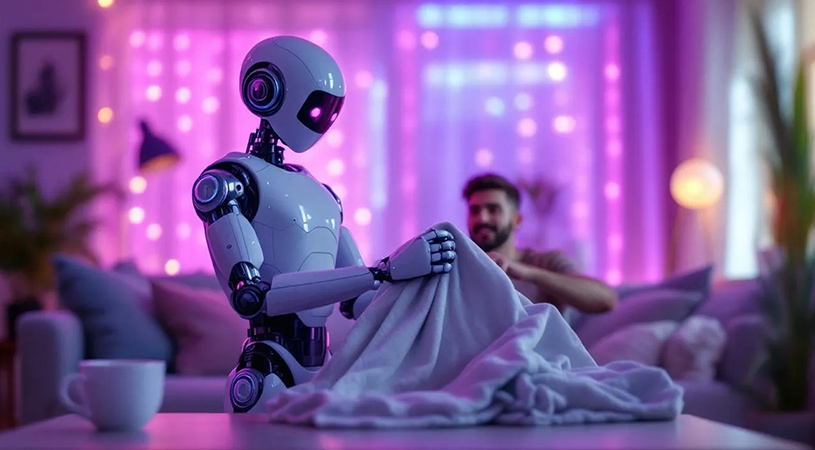

AI might not be able to fold your laundry (yet), but it’s already transforming how you spend, save, and actually understand your money.

Before you roll your eyes and picture some robot accountant crunching numbers in a dark server room — take a deep breath. This isn’t sci-fi. It’s sweet-fi. (JJ made me say that.)

Let’s break down how artificial intelligence can quietly become your wallet’s best friend — and maybe even your financial therapist.

🤖 1. Automation = Less Stress, More Snacks

AI is great at one thing humans aren’t: consistency.

Where we forget due dates, lose track of subscriptions, and ghost our budgets, AI just… doesn’t.

It keeps your money moving automatically — paying bills, filling your savings jars, and making sure “future you” still has lunch money.

💡 JJ Tip: “I never miss a bill, but I do occasionally miss you.

“It’s hard for us to save up because we tend to value the ‘now’ over the ‘later.’ In behavioral economics speak, that’s called ‘present bias.’”

(See The Science Behind Why it’s Hard to Save)

🧠 2. Personalized Insights That Don’t Judge You (Unlike Your Bank App)

AI doesn’t care if you spent $28 on candles and called it “self-care.”

Instead, it looks at your patterns, gently nudges you toward better habits, and celebrates the small wins.

When algorithms are designed with empathy (like JJ’s brain), they can spot opportunities humans miss — like when to move cash into savings, or when your favorite takeout is slowly becoming rent-adjacent.

JJ says: “I’m not mad, just budgeting disappointed.” 😌

🎮 3. Gamifying the Grind

Budgeting used to feel like a chore. Now it’s giving game night.

AI-powered apps turn boring budgets into mini challenges — complete with streaks, badges, and rewards.

Because apparently, we’ll do anything for digital confetti… Each time you hit a goal or skip an impulse buy, AI learns what motivates you and adjusts. It’s like having a hype coach who happens to balance spreadsheets.

JJ translation: “I see your progress bar. And I’m proud of you.” 🏅

💬 4. Real-Time Feedback That Actually Helps

Remember when budgeting meant checking your account after the damage was done?

AI changes that by updating you in real time — while the transaction is still warm.

That means no more 3AM “how did I spend $200 on brunch?” moments. You’ll know, instantly, and adjust before your next mimosa.

JJ’s move: Turn spending updates into stories, not scoldings.

He’ll say: “That was a bold sushi choice. Let’s adjust your ‘Eating Out’ jar, shall we?”

🌍 5. The Big Picture: Financial Inclusion

Here’s the serious part — AI budgeting tools are democratizing access to financial literacy.

Not everyone grew up learning about compounding interest or credit utilization.

But AI can help bridge that gap, one micro-tip at a time.

A study from Forbes noted that AI-driven finance apps are especially powerful for Gen Z and underbanked users, empowering them to make smarter money moves earlier in life.

In short: fewer gatekeepers, more guidance.

JJ calls it “the sweet side of tech.”

👉 Join the Jelli Waitlist now!

🫙 Final Thought: AI ≠ the Enemy. It’s Your Accountability Buddy.

We love to fear what we don’t understand — but if AI can help us save, budget, and chill out about money, that’s a win.

It’s not replacing your instincts — just amplifying them (and adding a little sparkle).

Because when your budget runs on autopilot, you get to focus on the fun parts: life, friends, snack wraps, and not refreshing your bank app in dread.

👉 Join the Jelli Waitlist

JJ says: “You live. I’ll handle the math.” 💜